It can seem daunting to ask how to build credit for someone new to finance. A credit account can make it seem like you're in a tight spot. Your poor credit score is likely to cause lenders to decline you. Good news! You can start building your credit as soon as you turn 18. If you follow these tips, it is possible to qualify for the best interest rate.

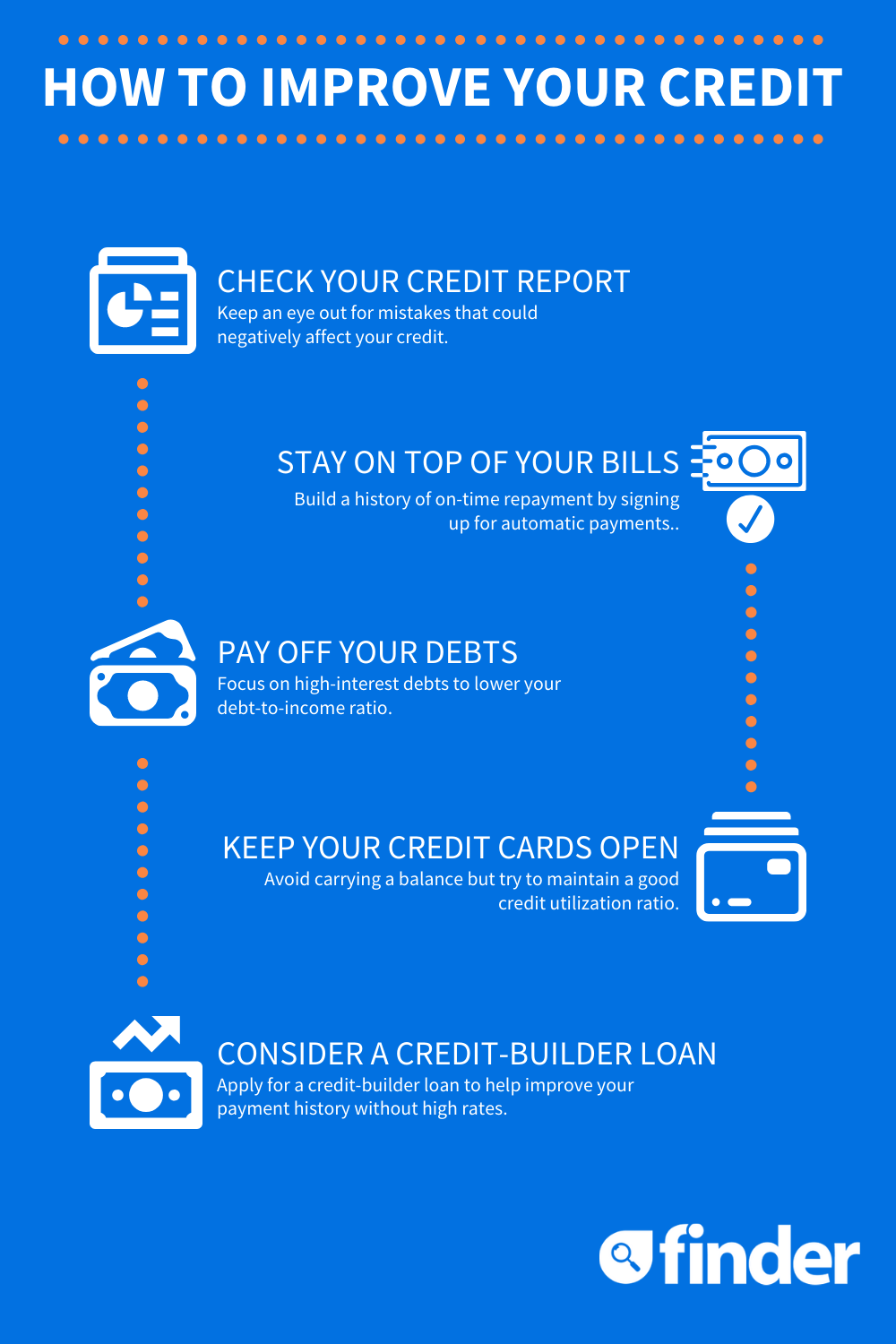

Timely payment of bills

A list of all your accounts is a great way to build credit and pay bills on time. Include the lender's minimum monthly payment and the amount owed. You can then divide this list according to whether you are paying manually or automatically. If you can, change the due date if possible, or use an automatic payment system. You can also specify an amount that you want to be debited automatically.

Your credit score will be affected by your payment history. More than thirty percent of your credit score depends on it. So make sure to pay your bills on-time. A late payment could result in a penalty or even a negative record on your credit report. Your credit report will most likely list your credit cards and loans, but sometimes utilities and cell phones report as well. Paying all of your bills on time can go a long way toward building your credit score.

Multiple credit cards

Having several credit cards may seem like a great idea, but it can also get you into financial trouble. While multiple cards can make it easier to spend, this can also lead to financial difficulties and significant debt. Avoid multiple cards that offer rewards. Only one card is better than the others. You will get the best results if you only have one card. Pay it off as soon possible. This will help you keep track, and save money.

While credit cards may help improve your credit score in the long-term, having too many can actually make it worse. It is best to only select the cards that you are able to responsibly use, and make minimum monthly payments. Multiple credit cards can also increase credit utilization. So make sure to use them sparingly. It's best to have two or three credit cards that are appropriate for your credit profile. It will improve your credit score if you keep track on your payments.

You can increase your credit limit

A good time to request an increase of your credit limit is after you have graduated from college, or if you have a steady income. You can increase your credit limit to make smaller purchases. This is the best way for you to increase spending power. It is easier than applying for a new credit card to request an increase. A request for an increase may also be made if you are a recent employee who is earning more or has received a raise.

After you have maintained good payment records, you should contact your creditor to request an upgrade. While you are waiting, explain why you need a greater credit limit. Your credit card issuer should know if your salary has increased recently. Creditors will be more interested in you if your credit limit is high. Remember that building credit does not automatically mean you are able to use a creditcard without paying any interest.

Credit builder loans

Getting a credit builder loan is an excellent way to establish good credit and improve your credit score. These types loans deposit funds to your account and require monthly installments towards the payment. Your credit score will rise if you make timely payments to the three major credit agencies. Your credit score will be affected if you make late payments. Credit builder loans are generally available through your bank, credit union or online lender.

Although credit builders loans don't require formal credit checks, some lenders use your banking history (provided to ChexSystems) in determining your eligibility. Having bounced a check can also impact your loan approval. You must be a member of a credit union to get these loans. You will need to pay a small membership fee, and occasionally, a donation to a partner organization.