When it comes to credit scores, does opening a new account hurt your score? While new credit has a negative impact, new accounts make up only 10% of your total score. Your payment history and credit use make up more of your score. Fortunately, there are ways to minimize the impact of new credit accounts.

Open a cash management account

A cash management bank allows you to manage money and make deposits without the need to open another checking account. These accounts don't usually have fees but you will need to pay fees if your money needs to be withdrawn early. Cash management accounts can be simpler than dedicated accounts. They also offer solid returns on your cash. Although they may not have all the same features as dedicated accounts, they can be a great choice for those who are busy managing their money.

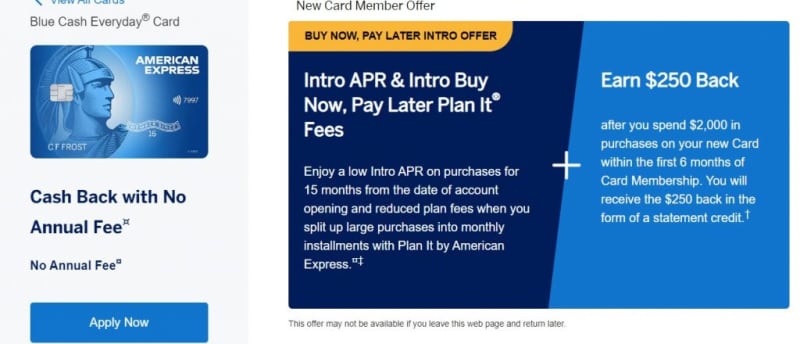

Avoid opening a new credit card

The opening of a new card account with a credit company can have a negative impact on your credit score. This can reduce your credit score by 15 percent as it lowers your average credit history. Also, a new credit card account will make you seem riskier to lenders, as you may have less available cash to pay your bills. You should wait until you have established credit before applying for a new card.

Do not open a new checking or savings account.

Although you might think that opening a new checking account won't hurt your credit, it's not true. There are banks that will assess your credit score and approve you for the account. While a "soft pull" will not affect your credit score, a "hard pull" (or hard inquiry) can have a negative impact on your credit score for as long as 12 months. Call the bank to prevent a hard inquiry.

Avoid overdrawing a checking account

It's tempting to spend more when you open a new account. A checking account with a generous excess fund policy is the best way to avoid this. It is also a smart idea to keep track and log all electronic transactions. This way you will know when you have sufficient funds and when you are close to zero.

Applying for a new card is a waste of time

Credit card applications may sound appealing but they can adversely impact your credit scores. The card should be used responsibly to help your credit score improve over time. Moreover, you should avoid applying for multiple new cards at one time. This way, you won't risk getting a hard inquiry just before an important loan application. WalletHub offers a free credit score simulation that will help you see how your new application might affect your credit score.

Avoid late payments on credit cards

Late fees are very common with credit cards. You can avoid them if you pay your bill on-time. It is easy to forget about paying the minimum amount. However, late payments can not only affect your finances but also your credit score and credit report. If you haven't missed a single payment before you can ask for a waiver.