If you are a consumer who has mediocre credits and is looking for a card that will help build your credit score, the Avant card could be an excellent option. This card is unsecured, reports to the three main credit bureaus and has a low credit limit.

The application for the Avant card can be made by filling out their online form. The company will review your financial situation and determine whether you are eligible for the card. The application process is super fast, usually taking 60 seconds or less.

One of the best parts about Avant is that you can use your account any time, day or night. You can access your account via a mobile application or web-based platform. You can also set up automatic payments for your bills.

You can also monitor your card 24/7 to know exactly where your money is at all times. You can also shop overseas and pay in the local currency without any additional fees.

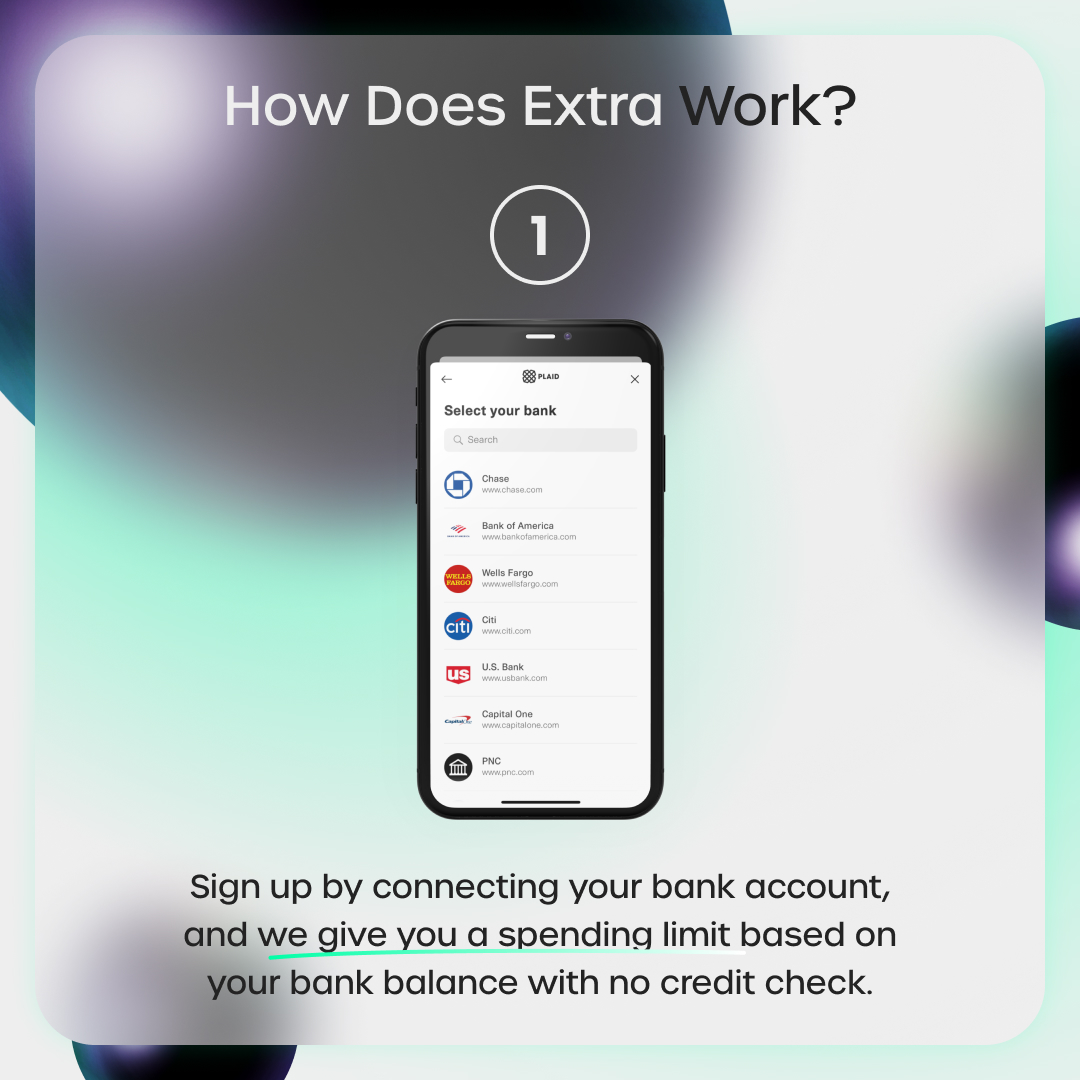

Acceptance for an Avant card can be easy. The company looks at your income, bill payment history and other factors to determine if you qualify for the credit line you're offered.

You can increase your credit limit in six months. You can link your card to a checking or savings account and set up automatic payments.

You may have a higher credit limit if you are on time with your payments and do not use up all of your available balance. Using this extra breathing room will help you keep your debt to credit ratio lower and improve your credit score.

You may also be eligible for a credit line increase if you haven’t used your card in the last six months or more than a full year. These reviews can be found on both the card's site and your account dashboard.

Even with a low credit score it is possible to get an Avant card, but the process may take longer. The company will evaluate your account and upgrade your credit limit, which could be as high as $3,000

The only downside to the Avant credit card is that you won't receive sign-up bonuses or welcome offers with this card. The $59 fee per year is still low in comparison to other unsecured credit cards.

Another positive feature is that the company shares your account data with all three credit bureaus. The card can help you to improve your credit score, but only use it on essentials and not expensive items or services.

The Avant card cannot be used to buy a house or car. To open an Avant Credit Card, you will need to provide a valid ID as well as proof of income.

As with all credit cards, you should pay your bills on time to avoid interest and other fees. It is important to not exceed the credit limit of your Avant card.