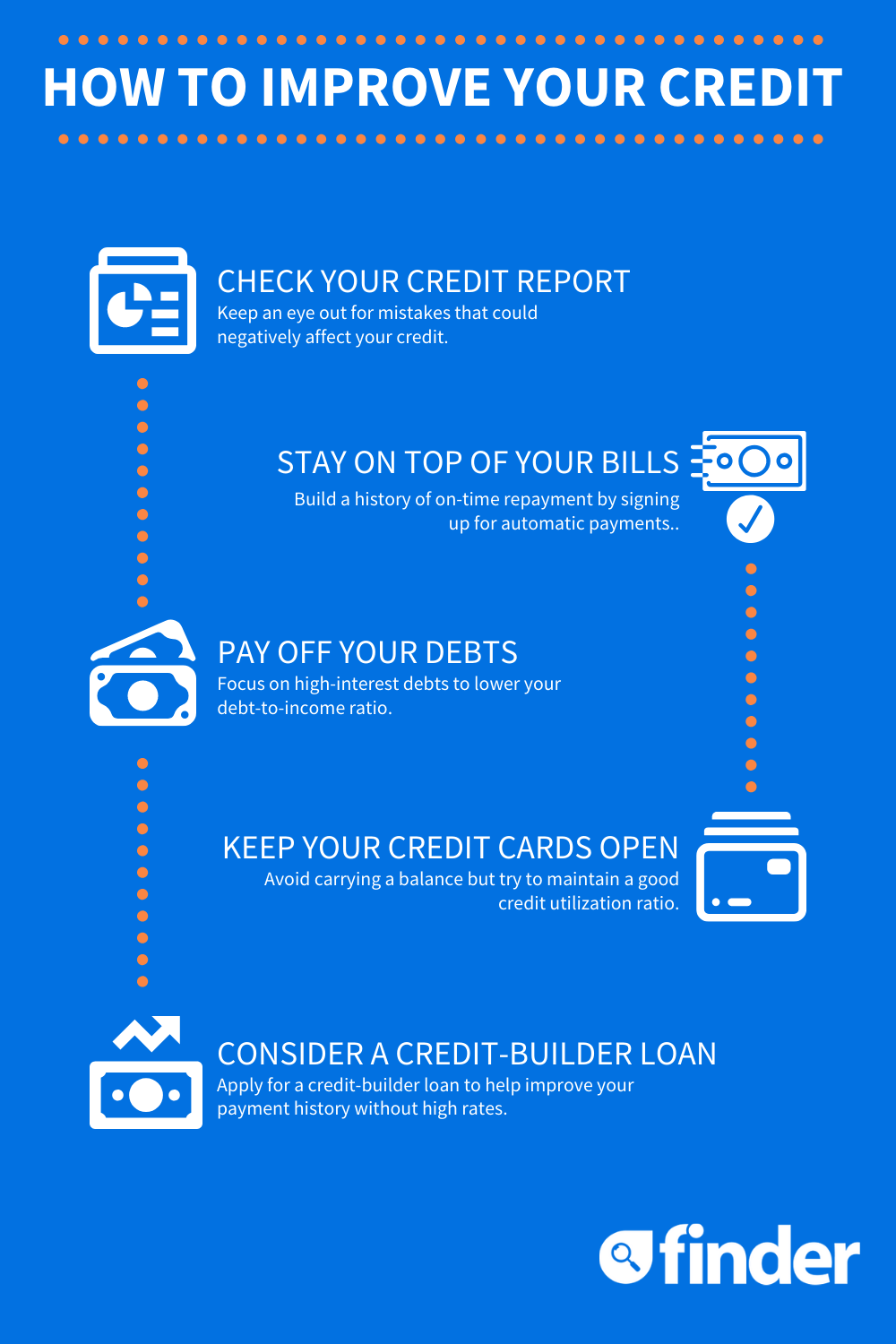

Your credit score is a very important part of the buying process, and a poor one can keep you from getting the car you want. There are several credit agencies that can help you check your credit, including Equifax and TransUnion. There is an easy way to see your credit score. This will give you an idea of your score.

Experian

FICO Auto score is a credit score which focuses on the credit history of a consumer in auto-related areas. These scores are preferable by auto lenders as they both show a consumer’s credit history and the details of their auto-related credit. TransUnion, Equifax, and Experian offer the FICO Auto Score.

Although they may have different scores, all of them represent the same information. FICO 8 and FICO 9 are two of the most common FICO scores. The FICO 8 is the industry standard and is used by many auto lenders and credit card companies. FICO 9, the latest version of FICO, is used by Wells Fargo as well as a few other companies. The TransUnion score is used by mortgage providers and is not as widely used.

TransUnion

TransUnion's Auto Score is a credit score which focuses on auto loan underwriting decisions. The company claims it is the only score of its kind in the market. The system combines trending and alternative credit data to produce an auto score. This score is used for lending decisions by auto lenders as well as subprime credit cards companies. This score predicts whether an individual will default or not on their credit cards and auto loans.

The score is determined by a variety factors and can range between 300 and 855. However, it is not a guarantee that an individual will be eligible for every type or loan. However, it will help them to understand their credit situation better and be eligible for loans.

Equifax

Your credit score is the first thing you should do when looking for an auto loan. Equifax, Experian and TransUnion are the three main credit bureaus that report credit scores. Each bureau calculates your score in a different way. Your credit score is what lenders use to decide if you're a candidate for auto loans.

The FICO(r), Auto Score, is a report that provides lenders with an indication of your ability to afford the car you desire. It features a scale of 250 to 900, and the higher your score, the less risk you are to default on your auto loan. It also increases your chances of qualifying for financing and receiving a better interest rate. Your individual credit score will depend on many factors, such as income and financial information.

Wells Fargo

Wells Fargo, one of the most important financial institutions in the globe, is Wells Fargo. They provide a broad range of services including free FICO scores. These scores do not just apply to Wells Fargo. They are based on credit information taken from any one of three major credit bureaus.

The Wells Fargo network is a collection of dealers that can help you obtain a loan for your car. The Wells Fargo website doesn’t list these partners. You can however contact individual dealers to find out if their dealerships work with you. Although this may take some time it will tell you what dealerships are willing to offer you based your credit history.