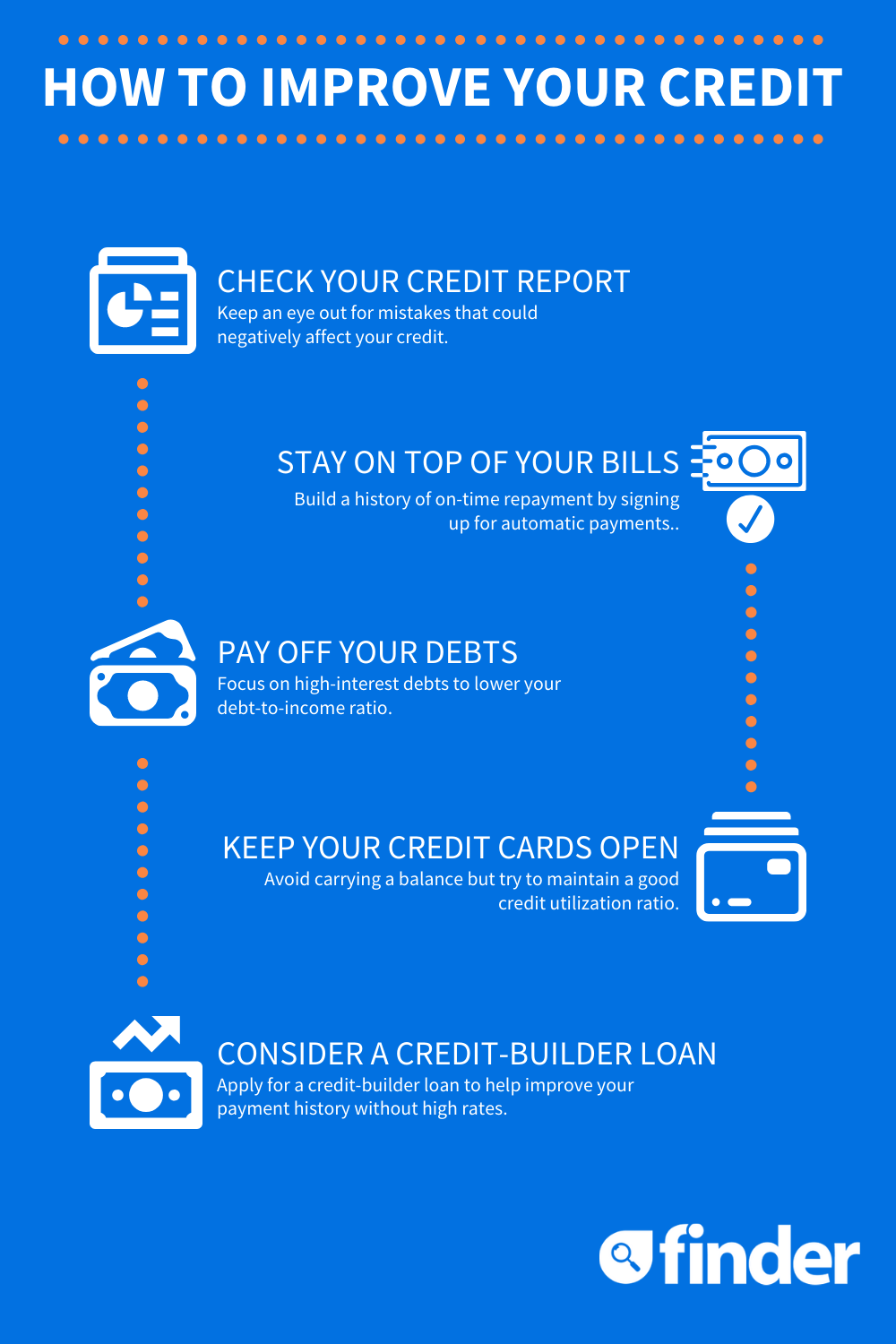

You don't have to be a credit expert to improve your score. There are many options available to you, including paying off your debt on time or disputing inaccurate information on your credit report. Here are a few examples: applying for a new credit card, addressing inaccuracies on your credit report, and taking out a non-revolving line of credit.

Timely repayment of debt

To improve your credit score, one of the most important actions you can take is to pay off your debts on time. Your score is calculated by several factors. The main one is how much money you owe. A low balance on your credit cards will increase your score. This will also help you qualify for lower interest rate. It is best to pay down the entire balance as quickly and as little as possible, if you don’t own enough cash.

You should first aim to keep your total debt below 20% of the credit limit. This will lower your credit utilization, which is how much debt you owe relative to your credit limit. Keeping your balances below 20% will raise your score. You can create alerts to remind yourself of due dates if you have trouble paying your bills. You can also call credit card companies to ask for a larger credit limit. It shouldn't take much time.

Applying for another credit-card

There are several things you can do quickly to increase your credit score. First, don't apply for new cards with annual fee. To make the annual fee worthwhile, you may need to take advantage of the rewards programs offered by these cards. When you apply for new credit cards, make sure to not increase your credit card spending. This will lower your credit utilization which will improve you score.

Third, limit your credit card usage to no more than 30% of your credit. This will reduce your credit utilization to less than 20%. You can improve your credit score by only using a small amount of your credit. Don't borrow all your credit. You could appear risky.

Dispute credit reporting inaccuracies

If you find inaccurate information on your credit report, take steps to dispute it. You can file a dispute online or with your account provider. Also, make sure to attach copies of supporting documents. Credit scores can be affected by how quickly a dispute is resolved.

If you are not able to resolve your dispute within a reasonable time, contact the credit bureau. The credit bureau should respond in writing and send you an updated copy of the credit report. While the dispute does not affect your free annual credit reports, it may appear on subsequent reports. A copy of the dispute statement may require you to pay a fee. For a sample dispute correspondence from the credit bureau, you can ensure you receive the correct answer. The dispute letter should be sent by certified mail, or with a copy of the return receipt.

Take out a nonrevolving credit line

Credit scores show how attractive a borrower can be to lenders. There are many ways to calculate credit scores. However, the majority of lenders consider five factors. One of these factors is the amount of debt a borrower has compared to the amount of credit available. Your credit score will rise if your credit utilization is lower. Additionally, by paying down existing balances, you can increase credit limit.

Inactivity on credit cards can lead to a drop in credit scores. FICO likes to see recent activity on revolving accounts. Although not all cards must have a balance on them, it can affect your score if there isn't enough activity.

Applying for a secured credit card

A secured credit card is a great way to improve your credit score if you have bad credit. Secured cards require you to make a deposit and provide credit bureaus with a history of good payments. However, you should use the card responsibly, and try to keep your balance below 30% of your credit limit. There are many different types of secured credit cards available.

Secured credit cards require a deposit equal to your credit line. For this deposit, you should save money. Once approved, you should choose a card offering low deposits and reasonable credit lines. To avoid interest accruing, ensure that you pay your balance every month in full.