Capital One has several credit cards, including the Spark Cash for Business, Capital One Platinum Secured Credit Card, and QuicksilverOne. If you're interested in getting one of these cards, there are a few things you should know before you apply. It is important to determine which credit card is best for you.

Capital One Spark Cash for Businesses

Capital One Spark Cash for Business creditcard has a maximum credit limit of $5,000. Credit limits are determined by your credit rating and how much income you make each year. To increase your chances of approval, you can make a few regular payments to your existing card. You may also combine multiple same-day inquires to get a higher credit limit.

Although this card may be used for business purposes, it also makes a great choice for companies that require access to their credit to finance large purchases. The card's 0% intro APR for purchases and balance transfers makes it attractive and helps companies pay large start-up costs.

Capital One Platinum Secured Kreditkarte

If you have a good payment history and consistently pay your monthly bill, you may be able to increase your Capital One Platinum Secured credit card limit. A deposit equal to your credit limit must be made within six months. You must make at most five payments during this time.

You must have at least $425 per month in income to be eligible for the Platinum Secured card. Capital One can reject your application if your income is not sufficient and ask you to deposit a security deposit. Capital One might reject applications from those with a history in late or missed payment. If you can maintain the minimum payments, however, you may still be approved.

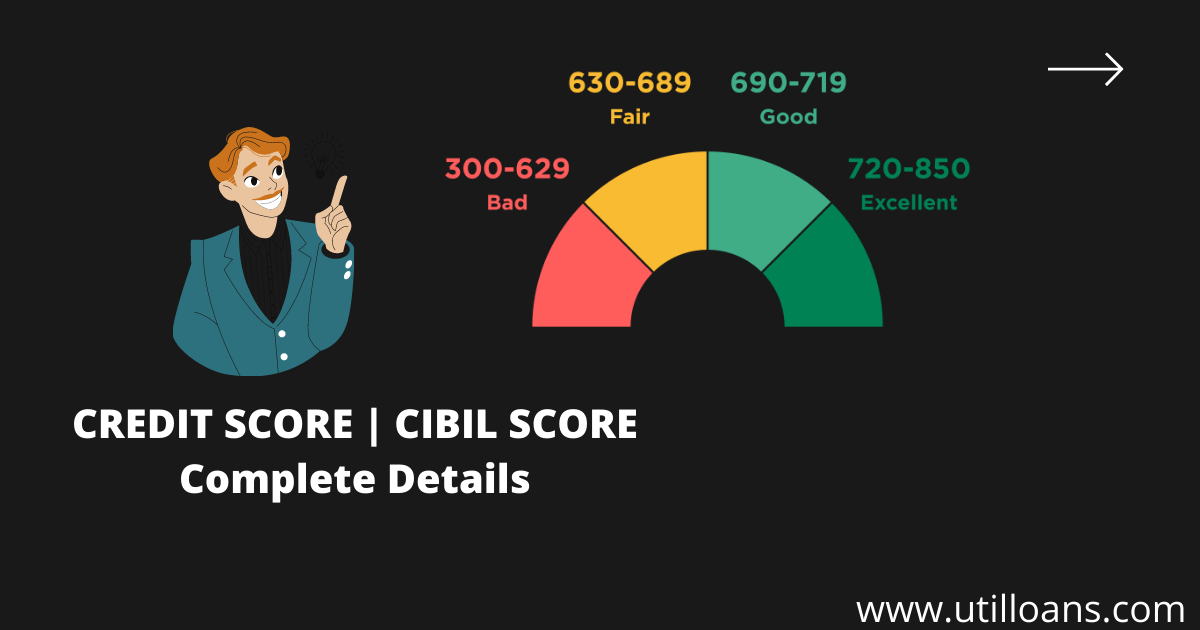

Capital One Platinum Secured Credit Card allows you to build credit, but credit utilization must not exceed 30%. Credit utilization is the second most important factor that will determine your credit score. Low credit limits can limit your spending power, while high utilization rates can cause lower credit scores. For example, a $300 credit limit means that a person has $60 left to spend. This makes credit building difficult.

Capital One QuicksilverOne

Capital One QuicksilverOne, a credit-card with low interest rates but low annual fees is the best. This card is an excellent choice for credit repair. It has a low annual cost of $39 and offers 1.5% cash back on purchases. You don't have to pay a foreign transaction fee. You don't even need to have great credit to get this card, unlike other credit cards.

Capital One QuicksilverOne credit card includes a $300 credit limit. It is a small credit limit, but it will not impact your credit score. You must make your payments on-time. The total amount you owe is used to calculate your credit score, not the credit limit. You can request a higher credit limit if you make five or more timely payments. Capital One will increase your credit limit after six months if you continue to be good.

Capital One QuicksilverOne cash credit card offers a unique option for those with average to high credit scores. The rewards program is simple to use and earns 1.5% cashback on all purchases. Redeem your rewards for paper checks or statement credits. The rewards rate on this card is higher than those of other cards and it has an annual cost. It has no minimum spending requirements and doesn't require a security deposits.