Credit Karma has the potential to have an adverse effect on scores. This service can use your credit history in order to place advertisements. These ads are very similar to Facebook. You can take steps to guard your score against Credit Karma.

VantageScore is a scoring model created by the credit bureaus

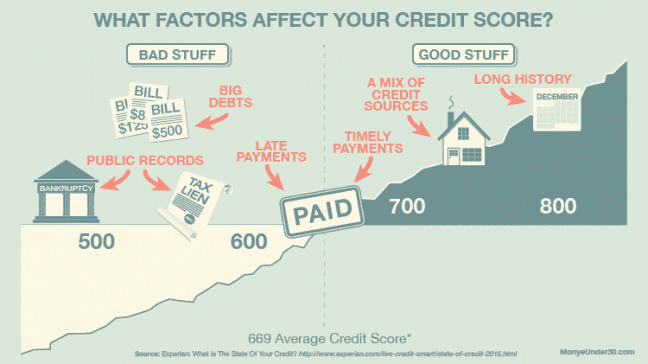

VantageScore depends on many factors. Your credit report also contributes to your score. Your score can be affected by your credit history. For instance, if there have been many late payments, it will be lower than if there were only minimal payments. Credit score calculators are a great way to increase your credit score.

It differs from FICO scores

There are important differences in FICO scores and Credit Karma score. FICO scoring models are more commonly used by financial institutions. Credit Karma, however, uses VantageScore (r). These scores are still similar to FICO scores, but they look at different factors, including length of credit history, new credit and the mix of credit types.

It's a gentle check

Credit Karma is a free service that displays your credit score and helps you improve it. It breaks down your credit score into weighted categories and identifies areas that need work. It also helps you find errors on your report and spot signs of identity theft. Regularly reviewing your credit score is essential.

It is completely free

Credit Karma allows you to check your credit score and get a report for free. Each time you use Credit Karma, it counts as a soft inquiry, which does not negatively affect your score. Hard inquiries, however, are recorded on your credit record and can cause a 5 point drop in your score. Hard inquiries can remain on your credit report for up to 2 years. In addition to allowing you to check your credit report for free, Credit Karma also makes money by encouraging you to sign up for advertising-based products.

It is correct

Credit Karma is a service that breaks down credit scores into different factors, like credit utilization and payment history. It is possible to identify the factors that are affecting your credit score and make changes to improve it. To build credit, it is important to make timely payments. Two missed payments can have a huge impact on credit.

It is inaccurate

The good news is that there is a way to avoid the mistakes that most people make when using Credit Karma. Credit score models vary significantly from company to company, but the majority of credit scoring models use the same basic factors to determine a person's credit worthiness. These factors include how long you've been paying your bills and what types of credit you have. Credit Karma's score calculation is based on VantageScore(r).3.0, which uses FICO's basic factors to calculate a score.

How to dispute inaccurate information on a credit report

You should immediately dispute inaccurate credit information. To do this, you can write to the companies that reported the information and request a correction. It is important to ensure that the dispute letter you send is accurate and clarifies all facts. You can include a copy of your credit report or other documents to prove your case. Send your dispute letter by certified mail and include a receipt.