When they issue your monthly statements your credit card company may send you your revolving consumption to the credit reporting agencies. It can be difficult to maintain a low ratio of revolving credit. Schedule a payment prior to your creditor reporting your balance to the credit agencies. You will see a decrease in your revolving use if this is done.

Low revolving loan balances

Credit card companies report balances on monthly statements to credit bureaus. Your revolving usage rate will increase if you wait to pay your balance until the end. This can make it difficult to maintain a low debt ratio. But you can make a payment schedule so that your creditor does not report your balances on the credit bureaus.

Keeping your revolving debt balances low is important for maintaining a good credit score. Credit cards have high interest rates and can be costly to carry. Avoiding these types of debt is your best option. You can improve your credit score by following these steps.

Revolving debt reduction

The idea of reducing your revolving borrowing is not new. Revolving debt is a type of credit card with a monthly payment. Revolving debt does not include installment loans. However, credit cards and home equity lines of credit may be counted toward credit utilization. There are good news: you can decrease your revolving loan balances and improve the credit utilization score by paying your balances.

Paying off all revolving credit in full is the best way to reduce it. This will allow you to access more money as and when you need it. The interest will accrue if you are unable to pay the full amount.

Lowering credit limit on account

When your credit limit is lowered, it's important to work with the lender to make up for the loss. The company should be contacted to discuss the situation. You may be able increase your credit limit. If not, you can try calling another creditor. This might be a great opportunity to fix your bad credit record.

Your credit limit is the maximum amount you can borrow from your financial institution. This is usually determined by your income, credit history, and any other debt. It will impact your credit score as well as your ability to get future credit.

Reduce credit card balances

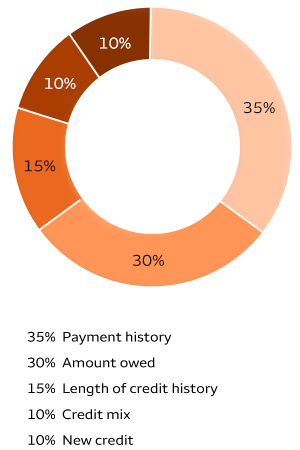

Borrowers need to be aware of the credit score factor called "revolving utilization". It refers to the amount of credit card debt that is greater than the total credit limit. Low revolving utilization is better for your credit score than high revolving. You can lower your revolving usage percentage without impacting your credit score.

Credit card balances can be a serious financial problem. It is very important to pay them off as soon as possible. You should aim to repay your credit card debts every month. This can prevent you from carrying your balances over to next month. Spreading your spending across multiple cards is a good way to ensure you don't max out one card.

Repayment of home equity credit

A home equity line is a revolving credit line that is secured against the borrower's property. The credit allows borrowers to borrow up to the maximum credit limit and offers flexible repayment terms. You can use it to cover large, ongoing expenses such as major home renovations or unexpected expenses such as medical bills.

A home equity line credit has a repayment period that includes both principal and interest payments. The length of your repayment period will vary depending on the amount of equity in you home. Most lenders will let you borrow up to 80 percent of your equity. Variable or fixed interest rates are also available.