Some credit card issuers are actively looking for new cardholders. This type offer allows new cardholders to feel more confident applying for a new account. Some cards come with intro offers that offer up to $300 cash back. These offers are especially appealing if you have bad credit.

Pre-qualification

You can get pre-qualifications for bad credit cards to help you determine your chances of being approved before you apply. Pre-qualification tools make use of soft inquiries to ensure you are not denied for credit cards. This process can help you to choose the best products, terms, rates, and conditions. It can take time to repair credit so it's best to wait before you apply for a card.

While pre-qualification only considers a portion of your finances, submitting a formal application with all of your information can help increase your chances of approval. Pre-qualification can be obtained through major credit card companies including American Express, Discover, Capital One, and Discover.

Pre-approval

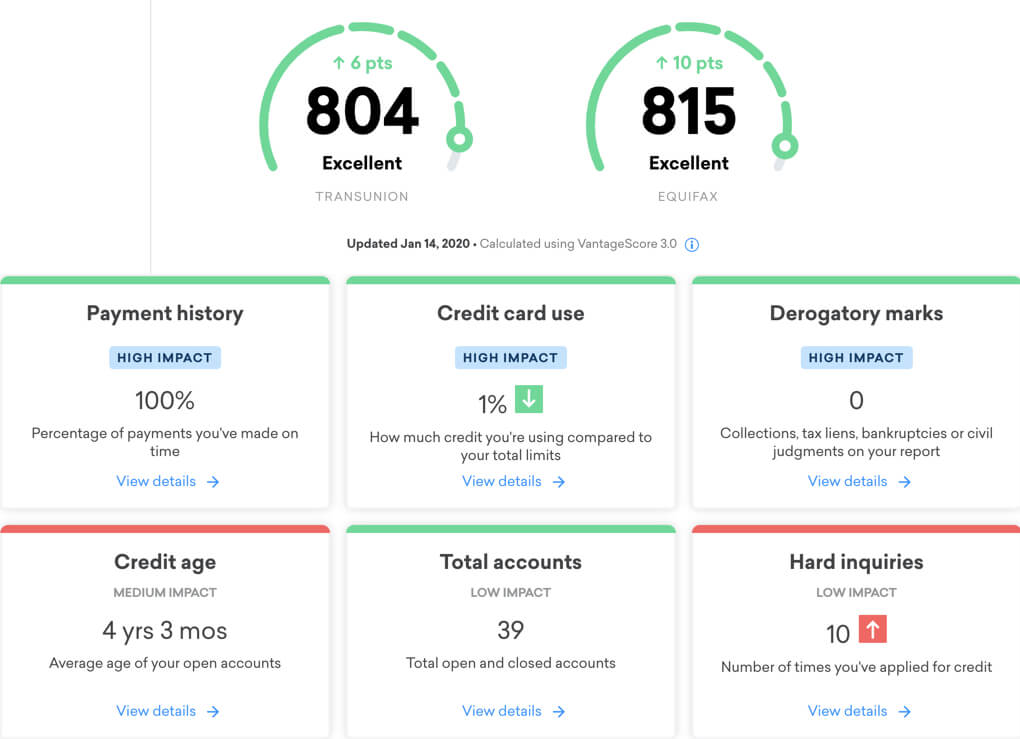

Pre-approval credit accounts for bad credit reduces your chance of being declined. These offers are typically based on pre-screened consumer lists that the card issuer obtains from credit bureaus. These pre-screenings could give you more product options and better terms and rates. However, before you take the pre-approval route, be sure to check your credit report for errors or derogatory marks.

A pre-approval credit card uses a soft credit check that does not look at your debt-to-income ratio or full payment history. It will not affect your credit score. Your credit score will be temporarily affected by a hardcredit check. Before you proceed, make sure to read the terms and conditions for each credit card offer.

Secure

If you have bad credit, a secured loan card may be an option. This card does not require a security deposit. It is only available for a very limited period of time. Many of them report payment activity directly to one of three credit bureaus, Experian or Equifax. You will want to check the terms of each card carefully before signing up for one.

The primary difference between a secured and an unsecured credit card is the security deposit. The security deposit, usually $200-$5,000, is what you pay to establish your credit limit. A secured card gives you credit access and allows you to build your credit history.

Unsecured

Bad credit can limit your access to unsecured credit cards, but that does not mean you can't get one. The key is choosing one that is geared toward people with less than perfect credit. While these cards may have high annual fees and credit limits, they can be used responsibly to build your credit score. Be sure to pay your bills in full each month and keep a low balance to avoid costly interest charges.

For people with poor credit, an unsecured credit card can be a great option. It can really make a difference in your finances. These credit cards provide a safety net for emergencies and let you pay your balances off over time. Some unsecured credit cards even offer balance transfer offers, which can help you repair your credit over time.

Low-maintenance

Pre-approved credit cards with low maintenance fees can be a good option for people with low credit scores. These cards have a low annual fee, no monthly fee, and no international transaction fee. They also do not charge late fees. Cardholders are eligible to have their credit limit increased after six months. However, they must maintain their personal credit score. You will also be able earn cash back of 2% to 10% on certain merchant purchases

Many issuers offer low maintenance pre-approved credit card options. You should review your credit reports and find out about the APR before you apply for these cards. Many issuers will run a soft credit investigation on applicants before they approve them. This inquiry will not have a negative effect on your credit score, but it will lower your credit score temporarily. Before signing up for any card, it is important that you read all terms and conditions.