Online credit cards for people with poor credit are now available. You can apply online for one for a low annual cost and get 2% cashback on your purchases. This card is perfect for rebuilding credit. These cards report monthly at the major credit agencies. If you already have one, it is important that you responsibly use it. Credit score building is possible by making timely payments and keeping your account in good standing.

Common questions regarding credit card for 500 credit score

People with a credit score below 500 are more likely to be denied loans and credit cards. These individuals are considered more at risk due to their poor credit rating. There are still options for those with low credit scores. People with 500 credit ratings can apply for credit cards.

For those with 500 credit scores, a secured credit credit card may be an option. These cards are often free of annual fees and offer rewards for purchases. They can help repair their credit.

Poor credit people are better served by unsecured credit cards

There are two types of credit cards: secured and unsecured. A secured card requires a security deposit from the applicant, while an unsecured card does not. Unsecured credit cards can be better for those with poor credit. However, they come with high APRs and steep fees. Before you make a decision about which credit card to apply for, be sure to assess your credit history.

Chase Freedom Unlimited card is an excellent example of an unsecured card for people who have poor credit. This card is designed for students. It offers 1.25% cashback for on-time payments and a student discount. The card was designed for students who don't have a lot of credit history but can still afford the monthly fee. It has an assistant that will help you keep track your due dates.

For a credit card with 500 credit score, you will need to meet certain requirements

If you have a credit score below 500, it can be difficult to apply for a credit card. The best way to increase your chances of getting approved is to improve your score. A higher credit score means more credit options and lower interest rates. You also have a greater chance of approval if you have fewer collateral requirements.

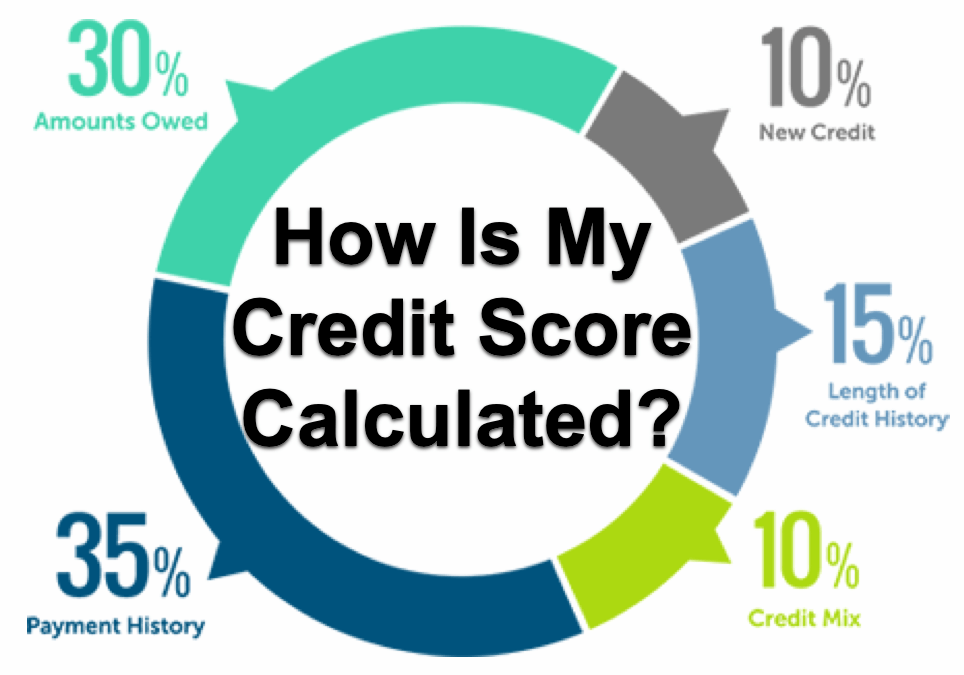

A credit score under 500 is considered low, but you can still obtain a credit card with decent terms and work on your credit. Start by choosing a card that reports your credit history to major credit bureaus. It is important to avoid missing payments, and to keep your credit utilization low. These key steps will improve your credit score quickly.

Reward structure for a credit card that has a 500 credit score

Finding a credit card for people with a 500 credit score is not impossible, but it can be more difficult than finding a credit card for people with a better score. Credit scores below 600 will be considered "poor" in most cases. A score of 500 or less is considered very poor. A low credit score does not make it impossible. However, having poor credit can make it difficult to manage your finances. There are a few key steps that you can take to improve your credit score.

A secured card is another option. This card is typically free of annual fees and gives cardholders 1 to 2 percent cash back on all purchases. A secured card is a great way to improve your credit score. Secured cards can also be used to report your purchases to major credit bureaus every month, which will increase your chances of being approved. Your credit score will improve if you responsibly use your credit cards. Making all of your payments on time is crucial to repairing your credit.