It is essential to learn how to responsibly use credit cards in order to improve your credit score. Not only should you make minimum payments each month but you must also pay off your outstanding balance as soon as possible. This is the best way credit cards can be used. Paying off your balance each month will avoid paying interest on purchases and is an established strategy for building credit. Your payment history is the most important factor that will affect your credit score. You should make your payments on time and use the resources offered by many card issuers. Some of them let you set up automatic payment through your bank account.

Paying your balance in full each month

It's a smart move to pay off your credit cards in full every month. You will avoid any interest charges and establish a good credit rating. If you do this, you'll also show lenders that you are a responsible borrower, which can help you secure better borrowing terms in the future.

Avoiding accumulating interest

The best way to avoid compounding interest on a credit card is by paying off your entire balance each month. This is vital because credit card interest charges are tied to economic indicators such the Prime Rate. Your interest rate will change if the Prime Rate changes. Although paying your credit card debt in full each month is the best way of avoiding interest, it is sometimes not possible. If you are unable to pay your monthly balance in full, you can still make payments on the card until you have paid it off.

A credit card can give you rewards

A credit card can be a great tool for gaining a variety benefits, provided you are responsible. A credit card may give you additional points or cashback when you shop online. One example is a card that gives you 1% cash back for all online purchases. The rewards can be used for your balance payment or redemption for a statement credit. To avoid interest charges, make sure you pay your balance each month.

Avoiding defaults

There are many steps you can take in order to avoid defaults on credit cards. The most common step is to pay all your bills in full. While this is the ideal solution, sometimes it's not feasible. These situations are when creditors may be willing to work with your financial institution to come up with a payment plan. This can lead to lower interest costs and shorter payments.

Avoiding debt collector calls

Your rights are the first step to avoiding debt collector calls. You can not use foul language to threaten you with arrest or threaten you with imprisonment if you don't pay the debt. Even if you request them to stop, they can't keep calling. While they may call you by the name of an old friend, legitimate debt collectors will not.

Consolidating credit card debt

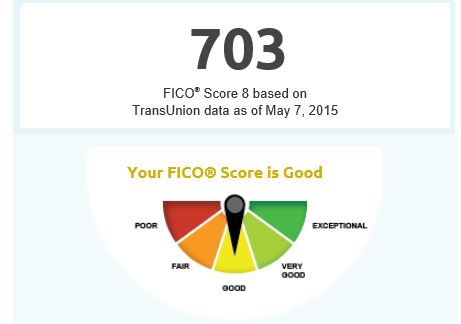

Consolidating credit card debt may be the best way to get rid of it. If you have a large balance on a few cards, you may be able to pay them off in a single loan. However, you will need to have good or excellent credit to access the best debt consolidation tools. You may not be eligible to receive the lowest interest rates, even with good credit.