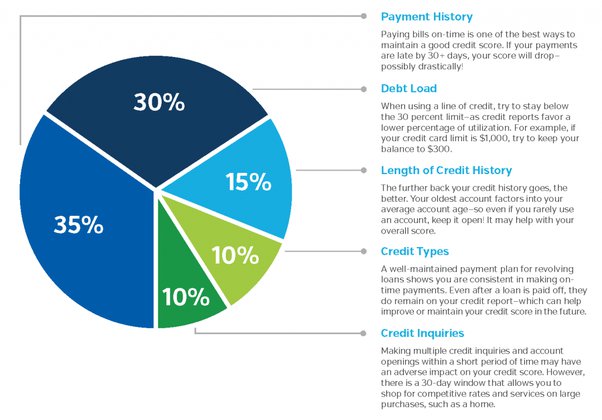

People with fair credit have many benefits, but there are still some things to be aware of. Your credit utilization will determine your score, and experts recommend using only 30 percent of your available credit. To improve your credit, you must pay off all debt. Paying your bills on time is the best way to improve credit. You can also put extra money down whenever you can to lower your balance. Your credit score will generally improve the lower your balance.

Capital One QuicksilverOne Rewards Credit Card

Capital One QuicksilverOne cash rewards is a great choice for people with fair-to-poor credit. The rewards program features an introductory cash-back rate of 1.5%, as well rotating bonus categories which allow you to get higher rewards for certain purchases. This card is great if you have fair credit. However, the annual fees are high and can be costly. You can also earn unlimited cashback on all purchases, with no limit.

If you don't have much credit history, getting a Capital One card can be difficult. Capital One cards might be suitable for students, immigrants, and temporary authorized users of another credit card. These cards are a great way to build credit history and establish good payment habits.

Capital One Platinum credit card

The Capital One Platinum Credit card might be a good option for you if your credit is fair or average. While this unsecured credit card does not have an annual charge, you will not receive rewards for using it. The good news about this card is that it is available without an annual fee and you can increase your credit limit if needed. This card will allow you to start building credit and earning rewards, all without the need for an annual fee.

The Platinum Credit Card for starters is available to anyone with good or fair credit. There is no annual fee, and there are no foreign transaction fees. You can also use it to make purchases in the local currency. This credit card is not subject to an annual fee like other credit cards. To make matters better, there are no foreign transaction fees, so you will never have to worry about paying them.

Discover Avant Credit Card

The Discover Avant Credit Card with fair credit is an unsanctioned card that allows borrowers not to have to deposit any security deposits and builds credit history. It is still competitive in credit-building, despite its few perks. Here are some factors to consider before applying. Foreign transaction fees are not charged by Avant Credit Card. Prequalification for the card is easy and free. You'll receive a decision within four weeks.

Avant Credit Card gives you the ability to get cash advances. This is allowed up to 25 percent of the credit limit. If your credit limit is $400 you can withdraw only $100 from a cash-machine. When you want to make large purchases, however, you'll need to pay back the money you borrowed. The Avant Credit Card offers no rewards program, but does have a few perks that may appeal to you.